TrID is a utility designed to identify file types from their binary signatures. While there are similar utilities with hard coded rules, TriID has no such rules. Instead, it is extensible and can. TrID is a utility designed to identify file types from their binary signatures. Last update 14 Feb. 2011 Licence Free OS Support Windows Downloads Total: 671. TRID Loan Purpose Chart Created Date: 0039Z. TRID the TRIS and ITRD database. DRIVER EXPECTANCY IN HIGHWAY DESIGN AND TRAFFIC OPERATIONS. Expectancy relates to a driver's readiness to respond to situations, events, and information in predictable and successful ways. It influences the speed and accuracy of information handling, and affects all aspects of highway design. Bundle file (Linux) ffw Bundle file (OS X) ffw Mach-O ffw.bup: DVD data file and backup data file pronom.buz: Buzzic v1.x ffw Buzzic 1.x module trid.buz2: Buzzic 2 module trid.bvd: BvD fileset trid.bvh: Motion Capture File trid.bw: SGI (image file format) ffw Silicon Graphics Image pronom Silicon Graphics B/W bitmap trid.bwe.

In order to make compliance with the new TRID requirements regarding agent license numbers on the new financial disclosure forms easier, the Commission is now including license numbers on the information provided on our website for individual licensee searches. Click on the “Licensee & Applicant Information Search” on the left side of the Commission homepage to access the licensee search function. The license numbers are displayed on the lower right of on the individual licensee information pages.

The TRID requirements from the Consumer Finance Protection Bureau regarding the paperwork required for closing most consumer credit transactions secured by real property, such as a traditional residential mortgage require real estate licensees acting as agents in the transaction to provide their individual salesperson’s or broker’s license number. In the past we have generally advised licensees to keep their license numbers private, however, they will need to provide them to the lending institutions under the new law. The forms also ask for a “State License ID”. This has been interpreted or referred to shorthand as a company ID or broker ID or license number. The Commission does not issue a “State License ID” to brokerage companies, and some lenders do not ask for it on the form. However some lenders do request a company or broker ID, in those instances the designated broker’s individual license number should be provided. The designated broker’s license number is also available on our website through the individual licensee search function.

Written and Published by: VanEd

In an effort to provide clear and helpful disclosures to consumers during the mortgage loan process, the Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act) directed the Consumer Financial Protection Bureau (CFPB) to integrate mortgage loan disclosures under two federal statutes: the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act of 1974 (RESPA). Under TRID, integration of the mortgage loan disclosures and the new forms’ clear language and design make it easier for borrowers to locate key information on their loan documentation, and easily compare the costs of different loan offers.

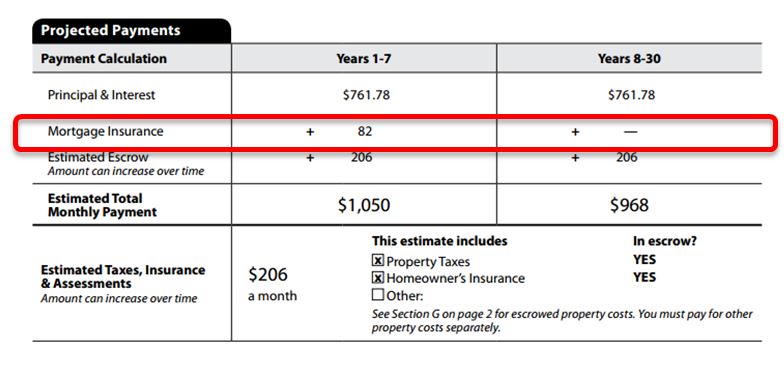

The Frequently Asked Questions (FAQ) focuses on the role of mortgage insurance with regard to the TRID rule.

1. Where does mortgage insurance (MI) fit into the overall TRID process?

If applicable to the loan, MI appears on the front page of both the Loan Estimate (LE) and Closing Disclosure (CD). Here MI is a payment calculation listed under “Projected Payments.”

MI also can appear in both the LE and CD under “Other Costs”.

2. When does mortgage insurance (MI) appear on TRID loans?

Certain MI rate plans must appear in the “Other Costs” section, while other rate plans may or may not appear on the forms.

MI that DOES appear on the LE and CD forms as “Other Costs – Prepaid:”

- BPMI (Borrower-Paid) Single

- Split Premium

- Annual

MI that MAY appear on TRID forms as “Other Costs – Initial Escrow Payment at Closing:”

- BPMI (Borrower-Paid) Monthly upfront payment

Tri Driver 4 Volt Lithium Ion Cordless Drill

BPMI Decision Tree: Is Borrower-Paid MI in Closing Costs?

3. What are the different tolerances and how do they apply to the various types of MI premium plans?

Trid Driver License Test

There are tolerance rules that apply to mortgage insurance (MI) and tolerance considerations will differ depending on the type of MI premium plan.

Monthly Premium Plans and Lender-Paid Plans are NOT subject to a tolerance rule.

Borrower-Paid Single Premiums, the upfront of Split Premiums and the Annual premium payment are subject to the 0% Tolerance rule, as it is a service that the borrower cannot shop for. Any upfront BPMI monthly payments are placed in escrow, and do not have a tolerance rule.

4. Is mortgage insurance a primary driver in the need for a revised Loan Estimate (LE) or Closing Disclosure (CD)?

MI will not be a primary driver in the need for a revised LE or CD. MI rates will change as a result of a change in LTV/FICO® or product type. Those changed circumstances will cause a change in MI, and drive the need for a revised disclosure.

Tri Driver

Lenders will need to remember to revise the MI if a changed circumstance warrants it, either in the revised LE or the CD.

5. Where can I get more information?

Please visit the Consumer Financial Protection Bureau (CFPB) website to learn more about:

CFPB Guidance

Trid Drivers

For informational purposes only – not intended as legal advice. Data derived from public sources.

Comments are closed.